A new study from Capital on Tap reveals the most supportive and most challenging UK cities for business expansion, based on economic strength, long-term business performance, start-up activity and household prosperity.

The report analyses five key indicators behind sustainable business growth, including five-year survival rates, GDP per head, employment levels, start-up density, and average disposable income. The findings highlight which cities offer the strongest foundations for new and growing businesses and where entrepreneurs may need to navigate tougher conditions. Capital on Tap also provided insight into what UK business owners wanting to expand can expect in 2026.

Top UK Cities for Business Expansion

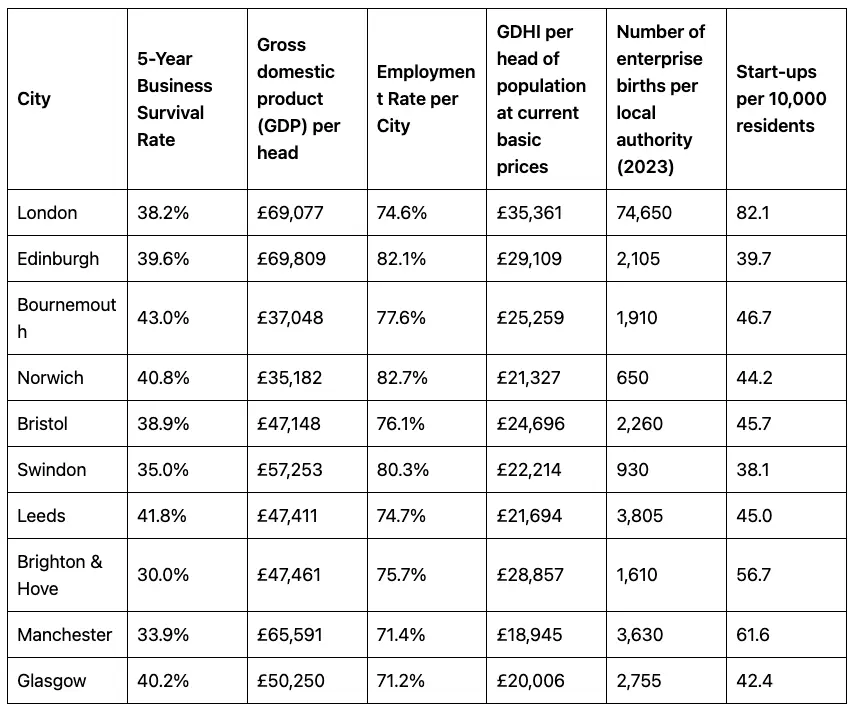

London ranks as the strongest UK location for business growth, driven by its exceptional economic power and high levels of opportunity. With a GDP per head of £69,077 and the highest disposable income in the dataset at £35,361, the capital provides a strong financial base for both consumers and companies. London also leads in entrepreneurial activity, with 74,650 enterprise births recorded in 2023, equal to 82 start-ups per 10,000 residents.

Edinburgh follows in second place, supported by impressive economic strength and strong employment. The city reports the highest GDP per head in the UK at £69,809 and an employment rate of 82.1%. Edinburgh also maintains a five-year business survival rate of 39.6%, demonstrating its long-term potential for small businesses.

Bournemouth secures its position as a standout city due to the highest five-year survival rate in the UK at 43%. With an employment rate of 77.6% and 46.7 start-ups per 10,000 residents, Bournemouth offers an environment where new ventures can take root and thrive.

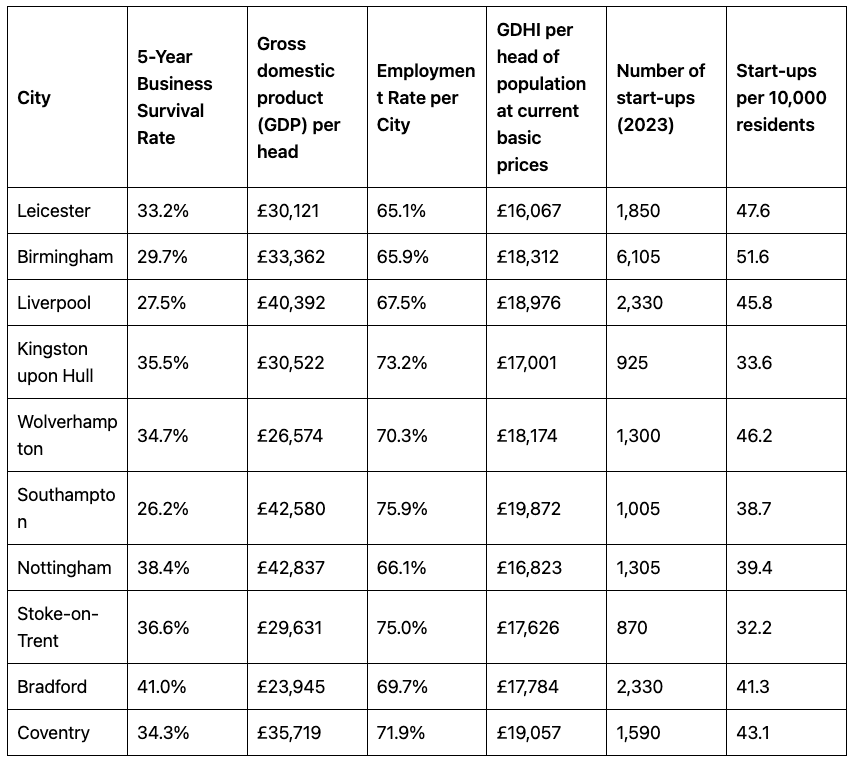

The study also reveals the UK cities where entrepreneurs face the toughest environment for building a business. Leicester ranks as the most challenging location overall, recording the lowest disposable income (£16,067), one of the lowest employment rates (65.1%) and a five-year survival rate of 33.2%.

Birmingham presents notable difficulties too, with a survival rate of 29.7% and an employment rate of 65.9%. Disposable income in the city stands at £18,312 per person, suggesting reduced local spending capacity. Despite 6,105 new enterprise births in 2023, its startup density remains lower than key competitors such as London and Manchester.

Liverpool faces similar barriers, reporting a survival rate of 27.5% and disposable income of £18,976. Although start-up activity in the city is relatively strong, its GDP per head of £40,392 and employment rate of 67.5% highlight slower economic performance that can limit revenue potential.

2026 Predictions for Business Expansion

Capital on Tap expects 2026 to be a year where measured expansion becomes the priority for many UK business owners.

According to Hugh Acland, CCO at Capital on Tap, while headline economic indicators show signs of stabilising, the pressures of the past two years continue to shape how founders plan for growth, meaning businesses are approaching expansion with greater financial discipline and clearer strategic intent.

“We are seeing business owners scrutinise every outgoing more closely than before. Costs have not returned to pre-inflation levels, which makes clear cash flow management essential. Add to this higher wage expectations, rising utility costs, and supplier price adjustments, the costs of running a business continue to reduce already tight margins, meaning we expect that real-time financial tracking and sharper operational oversight will continue to be important.

Having access to flexible finance, such as our business credit card, can make the difference between reacting under pressure and responding with confidence. It allows businesses to manage unexpected costs and invest at the right moment.”

Capital on Tap helps small businesses manage spending, access funding and earn cashback, travel and gift card rewards.